Traditional markets are looking for digital change

Key Points

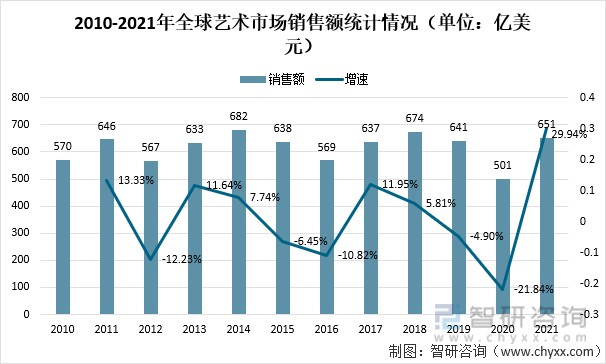

In 2021, the global art market experienced a 29% growth, with the total transaction value increasing from $50.3 billion in 2020 to $65.1 billion, even surpassing the pre-pandemic level of $64.4 billion in 2019. The characteristics of art assets as collections and value storage have been increasingly recognized, becoming a powerful tool in asset management for a growing number of high-net-worth individuals. According to the newly released "2022 Global Art Collection Survey Report," collectors' purchasing power for richer and higher-quality art pieces continues to strengthen. In a survey among collector demographics, Generation Z collectors possess the highest average wealth share in art pieces, with over one-third having more than 30% allocation, exceeding their Millennial and Generation X peers. This reflects a trend towards a younger demographic in the art market participants. Auction houses like Sotheby's report that 40% of their clients are new, mainly young people. As offline restrictions increase, the mixed live auction format combining on-site sales with online bidding is gradually gaining popularity. In 2021, 39% of buyers and 44% of bidders at Sotheby's were participating for the first time, and in a collaboration with digital artist PAK for an NFT auction, 78% of NFT bidders were new buyers to Sotheby's, with more than half under the age of 40. This new group of buyers, growing up in an internet environment and proficient in digital technology, prefers diversity. Coupled with the overall growth in wealth of high-net-worth individuals, this injects new vitality into the entire industry.

Figure 1 Global Art Market Sales from 2009 to 2021

Today, with the rapid development of digital technology, the trend towards digitalization in the art market is increasingly evident. It includes not only the digitalization of traditional art investment, collection, transaction, and exhibition but also encompasses emerging business forms based on digital technology, such as art appraisal, value discovery, and related financial derivative services. The development of digitalization links online and offline, allowing some small and medium-sized galleries to reduce costs and improve efficiency through digital online exhibitions and cooperative activities. Many major art fairs are also adopting digital strategies, not just for digital art sales but also using digital wallet transaction systems to help participating galleries expand their new clientele.

With the popularity of blockchain and the metaverse, the art market is beginning to engage in digital innovation, adopting innovative forms such as online live broadcasts and digital collectible sales to upgrade digital consumption experiences. They fully utilize the interoperability of digital information technology in the cultural field, significantly impacting the potential of the art market. As art becomes digitalized, huge changes have occurred in the collection, transaction, and circulation of art pieces. In the internet era, the value and price of art are no longer determined by a single factor but through a comprehensive assessment based on multidimensional data.

Figure 2 Digital Ecosystem of Art

From the supply side, traditional auction houses and galleries still dominate, but art e-commerce platforms, which primarily operate online, are rising. In the context of "Internet + Culture," new comprehensive service platforms for digital technology-based art, such as Weipaitang and Yitiaoyishu, continue to emerge. These new platforms provide more choices for the public and bring new vitality to the industry. An increasing number of new participants, including enterprises, celebrities, and capital, are entering this market. Renowned domestic entrepreneurs invest in art through art funds, celebrities use their influence to allocate personal assets in the art field to increase attention and achieve wealth appreciation. The digital development of the art market has become a new direction for growth. Some young collectors have invested heavily in digital art, with 5% of Generation Z and 4% of Millennial collectors spending more than $1 million.

Conclusion

Digital art platforms, with their advantages in resources, platforms, and funds, help to promote the formation of industry standards. Platforms focused on a specific business can use digitalization to enhance their professionalism, creating differentiated digital products and services. Art is known for its non-standard nature, and digitalization is an effective way to enhance the value of collections. All market participants, whether comprehensive service platforms or specialized market service platforms, are trying to seize the opportunity of digitalization to find new directions for development and improve their competitiveness in the larger economic environment.