Binance Research: Delving into the Realm of Real-World Assets

Key Points

In this blog series, we summarize the findings of the Binance Research team, inviting you to delve into the original reports. This article outlines a recent report by the Binance Research Institute on the current status of Real World Assets (RWA) in the cryptocurrency domain. Tokenization of real-world assets is a field with significant growth potential, currently the eighth largest branch of DeFi. Thanks to the Binance Research Institute, you can understand the development process of Web3 through industry-level analysis. We hope to share the latest knowledge in the cryptocurrency research field with the community through these insights. For an in-depth understanding, you can obtain the complete report on the Binance Research Institute website.

Recently, a major trend in the cryptocurrency domain is the integration of Traditional Finance (TradFi) with digital assets as large institutions enter the fray. An important part of this ongoing integration with heightened focus is the tokenization of Real World Assets (RWA), i.e., the process of incorporating off-chain financial assets into the blockchain.

Currently, the tokenization of real-world assets holds great development potential. This article explores the current status of tokenized real-world assets, delving into their background, prospects, and development. This article is a rewrite of a report published by the Binance Research Institute on July 25, 2023. Therefore, unless stated otherwise, this text mainly covers data and progress before this date.

Key Points

What Are Real World Assets?

Real World Assets (RWA) refer to tangible and intangible assets in the real world, such as real estate, bonds, commodities, etc. Tokenization of RWA involves transferring these off-chain assets onto the blockchain, thereby opening new possibilities and developing potential use cases. Tokenized RWA can be stored and tracked on-chain, improving efficiency and transparency while reducing the possibility of human error.

RWA示例

资料来源:币安研究院

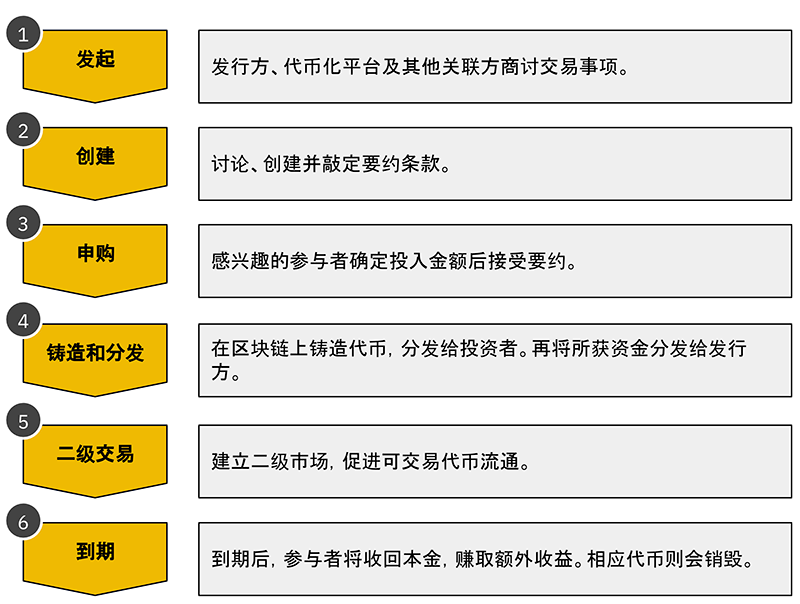

Tokenization Process

To transfer real-world assets onto the blockchain, it's necessary to consider transferring their ownership and representation onto the blockchain. The specific mechanism may vary, but the standard process involves defining terms and then minting tokens on the blockchain that represent the asset.。

链上代币化流程

资料来源:波士顿咨询公司、币安研究院

RWA Market Development and Future Outlook

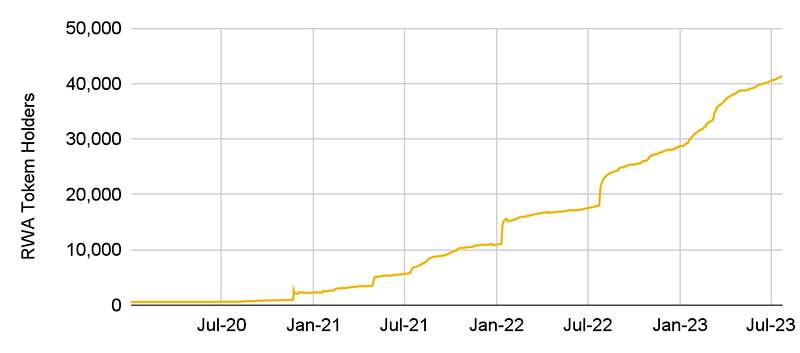

The RWA market is still in the early stages of development but has shown signs of increasing popularity and Total Value Locked (TVL) growth. According to data tracked by DeFi Llama, as of September 1, RWA is the eighth largest branch of DeFi, with a TVL of 1.3 billion USD. This rise from being ranked 13th at the end of June is sufficient proof of the widespread application of RWA protocols.

资料来源:Dune Analytics (@j1002)(截至2023年7月24日)

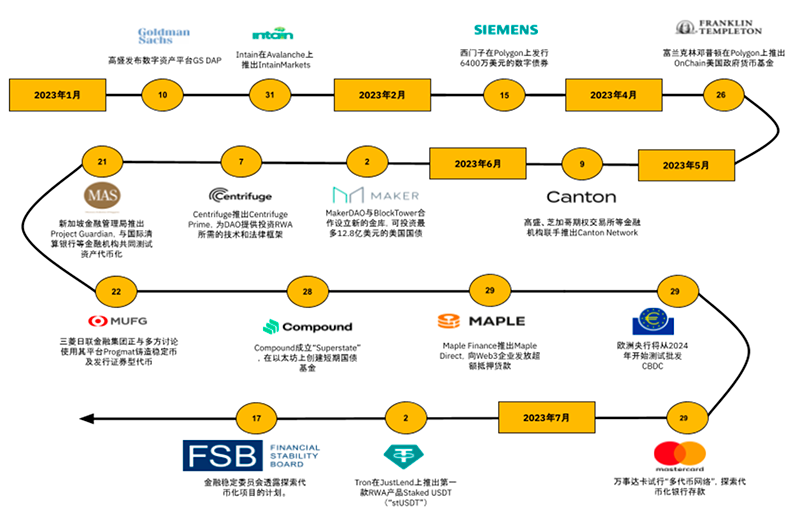

Significant Developments

In addition to DeFi protocols, traditional financial institutions have also shown increasing recognition of RWA. Some institutions have even begun exploring and building private blockchains for asset tokenization. As applications expand, we can see traditional trading platforms facilitating secondary trading of RWA. The field is becoming more mature, and regulatory formulation will promote mainstream application.

2023年机构应用和市场发展进程时间线

资料来源:币安研究院(截至2023年7月19日)

请注意,表中仅列出部分正在进行中的RWA项目。

Conclusion

The tokenization of real-world assets provides a highly potential success case for blockchain technology. With higher transparency and efficiency, tokenization offers more viable solutions beyond the current mechanisms. As traditional enterprises explore technologies to solve current inefficiencies, institutions also show signs of adopting tokenization.